Insurance-related Laws

1. Insurance Contract Act (2008)

The Insurance Contract Act stipulates the basic matters of rights and obligations, etc. between policyholders and insurance companies regarding insurance contracts.

Specifically, it classifies insurance contracts into general insurance, life insurance, and accident and sickness fixed amount insurance, and sets the following rules as to the time when an insurance contract is materialized, insurance benefits are paid, and an insurance contract terminates:

(1) Materialization of an insurance contract (Objective of an insurance contract, duty of disclosure, delivery of documents when an insurance contract is concluded)

(2) Validity of an insurance contract (An insurance contract for the benefit of a third party, over-insurance, a reduction in insured value, a reduction in risk)

(3) Insurance benefits (Prevention of occurrence and expansion of damages, notification of occurrence of damages, exemption from an insurer's liability, assessment of the amount of damage, under-insurance, double-insurance, beneficiary payment period)

(4) Termination of an insurance contract (Cancellation by policyholder, cancellation due to nondisclosure, cancellation due to an increase in risk, cancellation due to serious reasons, effectiveness of cancellation), etc.

Note

The Insurance Contract Act enforced on April 1, 2010 was formulated by changing the provisions in the conventional Commercial Code regarding insurance into an independent law to have the content be in tune with modern society and with the objective of protecting policyholders.

2. Insurance Business Act (1995)

The objective of this act, which gives due consideration to the public responsibilities of the insurance business, is to protect policyholders' interests by ensuring the sound management of insurance companies and the fairness of insurance soliciting activities.

This act is a main pillar of the Japanese insurance supervisory laws, stipulating the supervision of both insurance companies and insurance soliciting activities.

As for the supervision of insurance companies, various provisions are stipulated on the following matters: licensing requirements, the legal status of insurance companies, scope of business, accounting matters, examination criteria for insurance products, measures to maintain the sound management of insurance companies, measures to protect policyholders in case an insurance company goes bankrupt, etc. Provisions to the same effect apply to foreign insurance companies operating in Japan from the viewpoint of ensuring equal footing with domestic companies.

With respect to the supervision of insurance soliciting activities, the act stipulates the following provisions: registration and notification of those who engage in insurance distribution, prohibition of misconducts in insurance distribution, inspection of general insurance agents, a cooling-off clause, etc.

3. Act on Non-Life Insurance Rating Organizations (1948)

The objective of this act is to promote sound development of the general insurance business and protect policyholders' interests by ensuring appropriate business operations by non-life insurance rating organizations when calculating "reference loss cost rates" and "standard full rates for Compulsory Automobile Liability Insurance and Earthquake Insurance on Dwelling Risks". The General Insurance Rating Organization of Japan was established based on this law.

4. Automobile Liability Security Act (1955)

This act was enacted to provide financial security to traffic accident victims. As specified in the law, an automobile without a Compulsory Automobile Liability Insurance (CALI) policy must not be operated. This policy only covers liability for bodily injury for traffic accident victims, not liability for property damage.

5. Act on Earthquake Insurance (1966)

This act was established with the objective of contributing to the stability of the lives of those who suffer as a result of earthquakes. Under this act, earthquake risks on dwelling houses and contents are covered with reinsurance support provided by the government. Since the likelihood of catastrophic losses on dwelling risks following an earthquake is high, the aggregate limit of indemnity is shared among all private insurers and the government, who are liable under the excess of loss reinsurance cover arranged through the Japan Earthquake Reinsurance Company.

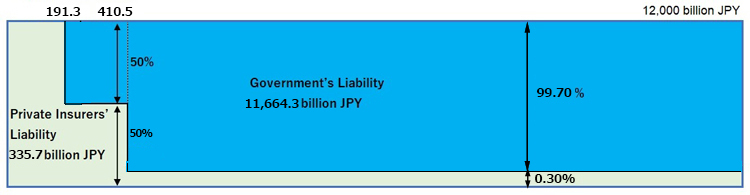

Liability Sharing Scheme between the Government and Private Insurers (as of Apr. 2, 2025)

|

1. Up to 191.3 billion yen: |

Private Insurers are liable for 100% of the claim |

|---|---|

|

2. Over 191.3 billion yen up to 410.5 billion yen: |

The Government is liable for 50% (109.6 billion yen) |

|

3. Over 410.5 billion yen up to 12,000 billion yen: |

The Government is liable for 99.70% (11,554.7 billion yen) |

Transition in Revisions of Earthquake Insurance on Dwelling Risks System

|

Effective Date |

The Extent of Loss to be Indemnified |

Insurable Proportion |

Limit of Cover |

Aggregate Limit of Indemnity per One Event |

|---|---|---|---|---|

|

Jun.1, 1966 |

Total loss only |

30% of the insured |

Building: 0.9 million yen |

300 billion yen |

|

May.1, 1972 |

Building: 1.5 million yen |

400 billion yen |

||

|

Apr.1, 1975 |

Building: 2.4 million yen |

800 billion yen |

||

|

Apr.1, 1978 |

1,200 billion yen |

|||

|

Jul.1, 1980 |

Total loss |

From 30% to 50% |

Building: 10.0 million yen |

|

|

Apr.1, 1982 |

1,500 billion yen |

|||

|

Apr.1, 1991 |

Total loss |

|||

|

Jun.24, 1994 |

1,800 billion yen |

|||

|

Oct.19, 1995 |

3,100 billion yen |

|||

|

Jan.1, 1996 |

Building: 50.0 million yen |

|||

|

Apr.1, 1997 |

3,700 billion yen |

|||

|

Apr.14, 1999 |

4,100 billion yen |

|||

|

Apr.1, 2002 |

4,500 billion yen |

|||

|

Apr.1, 2005 |

5,000 billion yen |

|||

|

Apr.1, 2008 |

5,500 billion yen |

|||

|

Apr.6, 2012 |

6,200 billion yen |

|||

|

Apr.1, 2014 |

7,000 billion yen |

|||

|

Apr.1, 2016 |

11,300 billion yen |

|||

|

Jan.1, 2017 |

Total loss | |||

|

Apr.1, 2019 |

11,700 billion yen |

Apr.1, 2021 |

12,000 billion yen |

Note

The revisions of April 1, 2009, May 2, 2011, May 16, 2013, Oct. 19, 2016, April 1, 2017, Feb. 14, 2019, Dec. 3, 2022, April 1, 2023, April 1, 2024 and April 2, 2025 refer only to changes of liability of private insurers and the government.

6. Consumer Contract Act (2000)

Under this act, a consumer is able to cancel a contract with a business entity when misrepresentation of the business entity misleads the consumer, or where the consumer is distressed by the importunate behavior of the entity at the time of contract. This act also stipulates that such provisions in the contract shall be void where the liability of a business entity is restricted or the amount of liabilities or damages claimed by the business entity against the consumer exceeds a certain level. Following enforcement of the revised Consumer Contract Act on June 7, 2007, a class action system for consumers was introduced, which allows a specific consumer organization the right to file an injunction against the misconduct of a business entity.

7. Act on the Protection on Personal Information (2003)

The purpose of this act is to protect the rights and interests of individuals while taking into consideration the usefulness of personal information, in view of the remarkable increase in use of personal information due to development of the advanced information and communications society. The act prescribes the duties to be observed by entities handling personal information such as: specification of the purpose of use, proper acquisition, notice of the purpose of use at the time of acquisition, security control measures, supervision of third party vendors, restriction of provision to third parties, disclosure, correction, stoppage of the use of personal information, etc.

8. Financial Instruments and Exchange Act (2006)

This act aims to establish comprehensive and cross-sectional rules for user protection, and to develop an environment where users can invest with confidence, thus responding to changes surrounding the financial and capital markets. Under the act, firms dealing with financial instruments are required to comply with the following rules of conduct (rules for sales and solicitation), which also apply to some insurance products: regulation on advertisements, obligation to deliver documents in a written format before/at the time of making a contract, various examples of prohibited conduct such as delivery of false information, prohibition of loss compensation, etc.

9. Act on Provision of Financial Services (2021)

The purpose of this Act is to protect customers who receive financial services, and thereby to contribute to the sound development of the national economy by ensuring sound and appropriate operations by financial service intermediaries through:

(i) providing for the liability of financial instrument providers, etc. for compensation in the event that a customer suffers damage as a result of a provider failing to explain important matters to the customer at the time of sale of a financial instrument, and/or other matters relating to the sale, etc.; and

(ii) implementing a registration system for persons acting as financial service intermediaries.

In response to the growing need for a one-stop shop for a wide range of financial services, including banking, securities and insurance, the Act on Sales of Financial Instruments was renamed the Act on Provision of Financial Services to enable intermediaries to provide all of the above services under a single registration.