Early Warning System and Policyholders Protection Scheme

As part of a scheme to protect policyholders' interests, the following measures have been introduced to the Japanese general insurance market: 1. Early warning systems based on the solvency margin ratio, whereby the supervisory authority can require an ailing general insurance company to improve its business operation and 2. The setting up of a policyholders protection corporation to deal with the possible insolvency of a general insurance company.

1. Early Warning Systems

On August 22, 2003, the FSA revised its administrative guidelines and introduced off-site monitoring and early warning measures in addition to the early remedial actions introduced in April 1999. An insurance company will be considered in sound condition if the solvency margin ratio is 200% or more. However, if the ratio falls below 200%, the supervisory authority shall take early remedial action on the basis of the provisions of the Insurance Business Law and its Enforcement Ordinance. Prior to the early remedial action, off-site monitoring and early warning measures will be taken when the Commissioner deems it necessary in order to improve the management of an ailing company which still maintains its solvency margin ratio at more than 200%.

(1) Off-Site Monitoring

Early detection and early remedy of managerial problems are the key to rehabilitating unhealthy insurance companies. The FSA has introduced off-site monitoring in order to grasp the insurance company's management condition by collecting a continuous flow of financial statements and risk information reports from insurance companies. The collected data is stored and analyzed quickly and effectively. Giving feedback on the results of the analysis and having interviews with the management of the company, the FSA urges the insurance company to carry out remedial plans independently.

(2) Early Warning Measures

Early remedial action based on solvency margin ratio is provided in paragraph 2, Article 132 of the Insurance Business Law as a measure to secure the soundness of an insurance company's management. Even an insurance company which does not fall under the scope of early remedial action shall be required to make continuous efforts to maintain and improve the soundness of its business. To that end, the FSA will take the following preventive measures to assure an early remedy of the management.

a. Remedial Measure for Profitability

b. Remedial Measure for Credit Risk

c. Remedial Measure for Stability

d. Remedial Measure for Cash Flow

The FSA, when necessary, may issue an administrative order for business improvement according to Article 132 of the Insurance Business Law, so that the company can be guaranteed to carry out the above remedial measures.

(3) Early Remedial Action

Early remedial action based on the solvency margin ratio was introduced in April 1999, as one of the key factors in the new insurance supervisory and regulatory framework.

The objective of early remedial action is to ensure the sound and proper business operation of an insurance company and the protection of policyholders by enabling the supervisory authority to urge insurance companies to maintain sound management with regard to their solvency margin ratios.

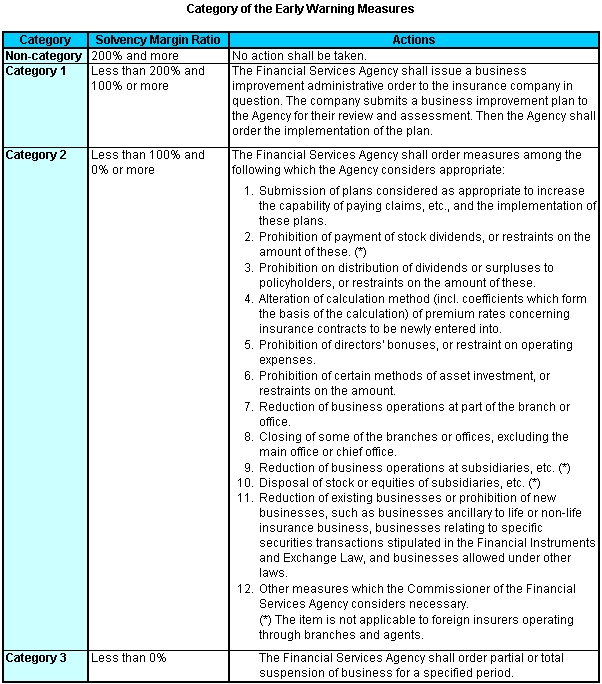

The Enforcement Ordinance requests that early remedial action be divided into 3 categories in accordance with the level of the solvency margin ratio.

In addition to the actions mentioned above, the Enforcement Ordinance includes the following measures:

a. If an insurance company finds that its solvency margin ratio falls to category 2 or 3, and if the insurance company promptly submits a business improvement plan that the supervisory authority judges to be appropriate to restore the company's solvency margin ratio, then the category of the order issued by the supervisory authority shall be applied to the category corresponding to the expected result of the implementation of the business improvement plan. However, if the supervisory authority does not deem the plan appropriate, the category of the order shall correspond to the decreased solvency margin ratio.

b. Even when an insurance company falls within category 3, the supervisory authority shall be able to issue an order that includes category 2 measures, when the difference between the assets and the liability of the insurance company shows a positive amount, or when it is obviously expected to become a positive amount.

c. Even though an insurance company does not fall within category 3, the supervisory authority shall be able to issue an order that includes category 3 measures; when the difference between the assets and the liability of the insurance company shows a negative amount or when it is obviously expected to become a negative amount.

d. The early warning measure shall not apply to the Japan Earthquake Reinsurance Company whose insurance contracts are reinsured by the government under the Law concerning Earthquake Insurance.

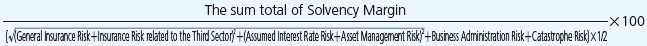

Solvency Margin Ratio

In addition to the reserves to cover claims payments and payments for maturity-refunds of savings type insurance policies, etc., it is necessary for general insurance companies to maintain sufficient solvency in order to provide against risks which may exceed their usual estimates. The solvency margin ratio means the ratio of “solvency margin of general insurance companies by means of their capital, reserves, etc.” to “risks which will exceed their usual estimates”. The solvency margin ratio is one of the indices which the supervisory authority utilizes in order to judge the management soundness of a general insurance company. It is understood that problems concerning the management soundness of a general insurance company will not arise if the ratio is 200% or more. The detailed formula of the calculation of the solvency margin ratio is as follows:

Solvency margin is the total of the following items:

1. Total Equities

2. Reserves for Fluctuation in Value of Investment

3. Reserves for Risks related to Assumed Interest Rates and Third Sector Insurance Products

4. Reserves for Catastrophic Risk

5. Allowance for Bad Debts

6. 90% of Latent Profit on Securities (100% of Latent Loss on Securities)

7. 85% of Latent Profit on Land (100% of Latent Loss on Land)

8. Others which the Commissioner of the Financial Services Agency considers necessary

The risks mentioned in the denominator are defined as follows:

1. Insurance Risk

a. General Insurance Risk: risk of occurrence of claims which exceed underwriting reserve.

b. Catastrophic Risk: risk of loss caused by natural catastrophes such as earthquake, storm, flood, etc.

c. Insurance Risk related to the Third Sector: risk of occurrence of third sector claims which are subject to uncertainty.

2. Assumed Interest Rate Risk: risk of not being able to secure the assumed interest rate, which forms the basis of calculation for underwriting reserve.

3. Asset Management Risk: This risk means the total of the following risks:

a. Risk of fluctuation in value, etc.: risk of occurrence of loss caused by excessive changes in the capital value or interest rate (evaluation based on market value).

b. Credit Risk: risk of occurrence of loss caused by bad debts or default (evaluation based on market value).

c. Risk arising in a Subsidiary Company, etc.: risk of occurrence of loss caused by the failure of investment in a subsidiary company or a related company.

d. Derivative Transactions Risk: risk of occurrence of loss caused by transactions of futures, options and swap, etc.

e. Reinsurance Risk & Recovery of Reinsurance Risk.

4. Business Administration Risk: risk of occurrence of loss beyond anticipation in business administration.

2. Non-Life Insurance Policy-holders Protection Corporation

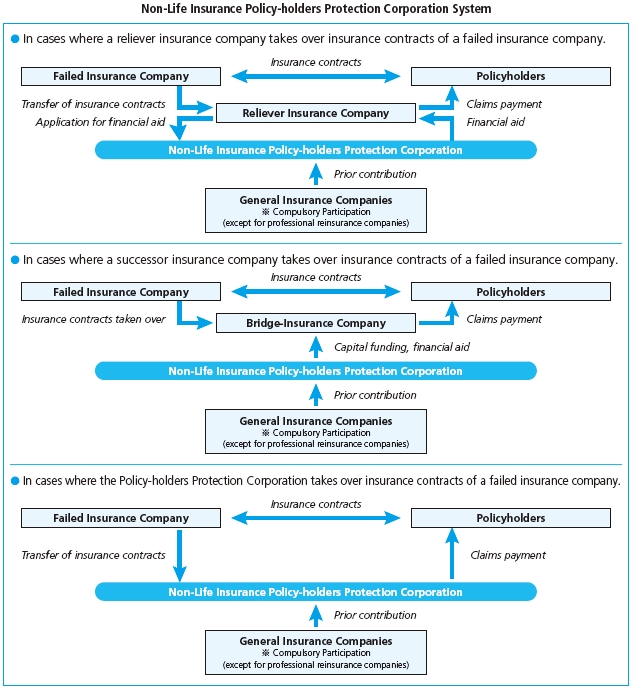

The "Non-life Insurance Policy-holders Protection Corporation of Japan" (hereafter, "the Corporation") was established in December 1998 for the protection of general insurance policyholders by an amendment of the Insurance Business Law. Before the establishment of the Corporation, the Policyholders' Protection Fund for Non-life Insurance Companies was introduced in April 1996. However, the fund system could not come into effect unless reliever insurance companies appeared in the event of an insurance company becoming insolvent. In order to resolve possible problems arising from this, the policyholders protection corporation system has been created.

The functions of the Corporation are to give financial aid to the reliever insurance company which takes over a failed insurance company, and to undertake the insurance contracts of a failed insurance company when reliever insurance companies do not appear. With the partial amendment of the Insurance Business Law enforced in June 2000, the scope of a Corporation's business, and methods of its financial aid have been expanded. This includes the establishment of a subsidiary "bridge-insurance company" funded by the Corporation to take over the insurance contracts of a failed insurance company, and to provide loans to insurance companies that have to stop paying claims due to temporary cash-flow problems or provide loans to a failed insurance company that has concluded a financial aid contract with the Corporation. In addition, by the amendment of the Law concerning Special Rules for Reorganization Procedures of Financial Institutions effective in June 2000, company reorganization procedures shall also be applicable to insurance companies, and the reorganization of failed insurance companies will proceed more smoothly.

(1) Objective

The Corporation carries out its functions to protect policyholders thus ensuring the reliability of the general insurance business.

(2) Membership

In accordance with the provisions of the Insurance Business Law, all the general insurance companies operating in Japan, including foreign insurers and one specific corporation (the Society of Lloyd's), have to join the Corporation. However, professional reinsurers, etc. are excluded.

(3) Types of Business Operations

The Corporation carries out the following types of business operations:

a. To provide financial aid to a reliever general insurance company to which the insurance contracts of an insolvent general insurance company are transferred.

b. To undertake the insurance contracts of an insolvent general insurance company, and to administer and/or deal with the insurance contracts, when reliever general insurance companies do not appear.

c. To establish a subsidiary ("bridge-insurance company") of the Corporation to take over the insurance contracts of an insolvent general insurance company, when reliever general insurance companies do not appear. The Corporation shall administer the business operations of the bridge-insurance company.

d. To provide loans to the members of the Corporation in the event that they have to stop claims payment to their policyholders due to temporary cash-flow problems.

e. To provide loans to certain policyholders, etc., of an insolvent general insurance company within the amount equivalent to claims incurred. This is when the general insurance company has stopped claims payment due to the issuance of an order to suspend its business operations by the supervisory authority.

f. To become an insurance administrator.

g. To purchase policyholders' rights on insurance claims filed with an insolvent general insurance company.

h. To purchase the assets of an insolvent general insurance company.

(Note)

When the Corporation or its subsidiary takes over the insurance contracts of an insolvent insurance company in accordance with the above-mentioned items of b. and c., and subsequently, when a reliever insurance company appears, the Corporation or its subsidiary shall transfer the insurance contracts of the insolvent insurance company to the reliever insurance company.

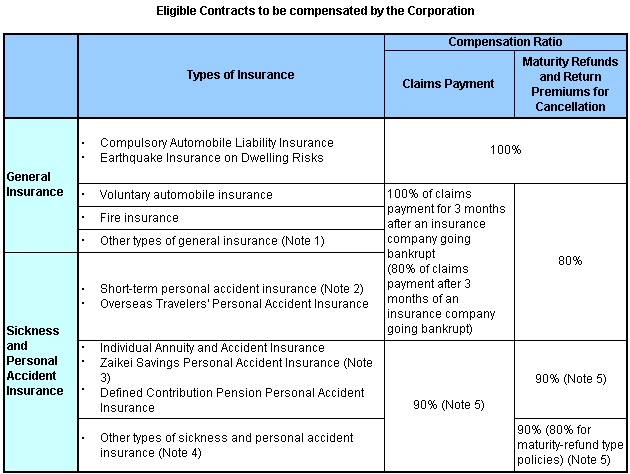

(4) General Insurance Contracts to be Compensated

With the revision of the Insurance Business Law effective from April 1, 2006, the new compensation scheme has been implemented for general insurance contracts.

The concept of the policyholders' protection scheme in life and general insurance has been basically the same, and 90% of underwriting reserves has formerly been guaranteed in the case of an insurance company becoming insolvent. Considering the characteristics of life and general insurance policies, the revised Insurance Business Law has provided a new type of scheme applicable to general insurance policies which are taken out by individuals.

The new scheme guarantees 100% of payment of claims which have occurred within 3 months after an insurance company has gone bankrupt. In case an insurance company goes bankrupt, individual policyholders are encouraged to replace their contracts with other insurance companies since the amount of claims payment will be reduced to 80% of underwriting reserves after that period. The new system has widened the types of policyholders who will be covered, and has provided protection for small- and medium-sized companies and condominium associations organized by the residents in addition to individual policyholders.

(Notes)

1. Other types of general insurance include general liability insurance, movables comprehensive insurance, marine insurance, inland transit insurance, credit insurance, workers' accident compensation liability insurance, etc.

2. Short-term personal accident insurance means a personal accident insurance whose policy period is less than 1 year.

3. Zaikei means an asset formation program for workers.

4. Other types of sickness and personal accident insurance are income indemnity insurance, medical expenses insurance, nursing care expenses insurance, etc.

5. Percentages may change according to contract conditions.

(5) Finance of the Corporation

a. The members of the Corporation must make a contribution to the Corporation in order to sustain the policyholders' protection funds and to meet the expenses of the Corporation. The ceiling on the total funds of the Corporation shall be 50 billion yen, i.e. ten times the total annual contributions of the members.

b. The amount of each member's annual contribution shall be decided with due regard to the amount of net premiums written and liability reserves accumulated.

c. In order to give financial aid to a reliever insurance company, the Corporation shall be allowed to borrow money from financial institutions, subject to the approval of the supervisory authority. However, a ceiling on such borrowing has been established, i.e. the total sum of the funds accumulated and the money borrowed cannot exceed 50 billion yen.

d. When the costs required for bankruptcy procedures exceed 50 billion yen, the Corporation shall ask the government to take necessary measures, with due regard to such conditions as the amount of funds accumulated, financial aid, etc. which has previously been provided, and the business soundness of the members of the Corporation.