Reserve Requirements

Underwriting funds for general insurance companies in Japan includes underwriting reserves, outstanding loss reserves, and price fluctuation reserves. These reserves are set aside subject to the Enforcement Regulation of the Insurance Business Act, the statement showing the basis of working out premiums and underwriting reserves, the Enforcement Regulation of the Act on Earthquake Insurance, Notices in the Gazette, the Comprehensive Guidelines for Supervision of Insurance Companies issued by the Financial Services Agency(FSA), and the Act on Special Measures concerning Taxation.

1. Underwriting Reserves

(1) Ordinary Underwriting Reserves

For all lines of general insurance business except Earthquake Insurance on Dwelling Risks and Compulsory Automobile Liability Insurance (CALI), general insurance companies must set aside an amount of unearned premiums or the "initial year balance", depending on which is greater, as their liability reserves.

As from fiscal 2005, regarding natural catastrophe related risks retained by general insurance companies, they must set aside an amount equivalent to an estimated unearned premiums calculated based on the amount of claims and the probability of such catastrophic event quantified.

(Note)

The "initial year balance" means premiums received during the fiscal year less claims paid and other expenses incurred under those contracts for which the premiums have been received in the course of the said fiscal year.

In order to ensure proper risk management of insurance companies and to facilitate their accumulation of premium reserves for future claims payment, the FSA has introduced a new rule for the accumulation of reserves for third sector insurance policies effective from May 1, 2006, so that insurance companies take the following measures:

a. Ensure that premium reserves are sufficiently accumulated based on a timely and accurate ex post facto examination

b. Verify whether technical reserves are sufficiently accumulated by applying stress tests

c. Disclose the results of the above tests

(2) Catastrophe Loss Reserves

The objective of the catastrophe loss reserves is to maintain adequate financial resources in order to prepare for future (possible) large losses.

Since its initial establishment in 1953, this indispensable system has been continuously developed to help ensure that insurance companies are fully prepared to pay claims by reviewing the lines of insurance covered by the system.

Catastrophe loss reserves must be set aside by every group of business, except Earthquake Insurance on Dwelling Risks and CALI.

The system is supported by tax incentives. The amount accumulated in the reserves qualifies for tax deductions (deductible expense).

When the loss ratio exceeds the specified level, the excess portion of the claims can be withdrawn from the reserves.

(Notes)

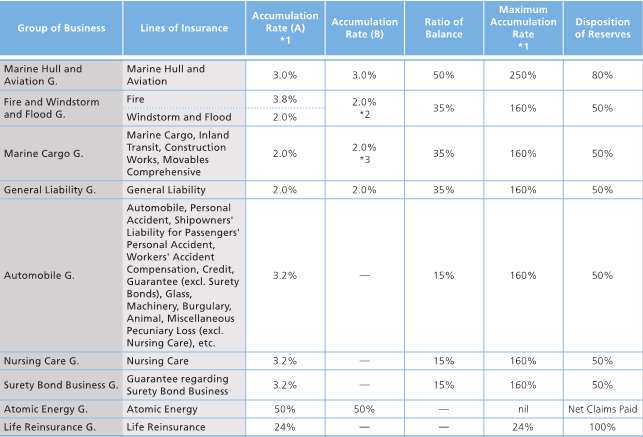

1. The above is an outline of the Catastrophe Loss Reserves system in Japan. (It is subject to rules not listed in the table or notes.)

2. Accumulation Rate (A) means the minimum percentage of net premiums stipulated under a statement showing the basis of working out premiums and underwriting reserves.

3. Accumulation Rate (B) means the maximum percentage of net premiums allowed under the Act on Special Measures concerning Taxation.

4. Insurers are legally required to accumulate either of the percentages or more, i.e. (A) or (B) greater of net premiums. They are allowed to accumulate an extra amount subject to notification to the FSA, but if the Ratio of Balance comes under the specified level mentioned in the table, they can accumulate an extra amount without such notification within a 150% limit.

*1 “Accumulation Rate (A)” and “Maximum Accumulation Rate” may differ from company to company.

*2 10.0% is allowed from FY2022 to FY2024 under the current transitional measures. (Under certain conditions, the original 2.0% applies (instead of the above transitional measure percentage).)

*3 6.0% is allowed from FY2022 to FY2024 under the current transitional measures. (Under certain conditions, the original 2.0% applies (instead of the above transitional measure percentage).)

(3) Reserves for Refunds

As regards policies issued with deposit premiums of a provisional nature subject to adjustment upon expiry of the policy period, and also policies issued for a premium on condition that the whole or part of it be returnable upon expiry without loss, sums required for refunds of such premiums should be reserved at the end of every fiscal year. As regards long-term comprehensive insurance, Family Traffic Personal Accident Insurance with Maturity Refund, and other maturity-refund type (or savings type) insurance policies which are written under an agreement to receive a savings portion of premiums from a policyholder at the outset and to refund it upon maturity at a fixed rate of interest, the sum corresponding to the present value computed at compound interest should also be reserved at the end of every fiscal year.

(4) Reserves for Dividends to Policyholders

For long-term comprehensive insurance, Family Traffic Personal Accident Insurance with Maturity Refund, and other maturity-refund type (or savings type) insurance policies, any balance between the sum of income arising from the investment of the savings portion of premiums combined with investment yield and the amount which has been set aside as "reserves for refunds" as explained in (3). above, should be reserved to provide for future payments of dividends to policyholders.

(5) Reserves for Earthquake Insurance and CALI

As Earthquake Insurance on Dwelling Risks and Compulsory Automobile Liability Insurance (CALI) have their social / public nature, and are operated under a so-called "no-loss, no-profit" principle, any underwriting surplus and investment income obtained from their businesses are set aside and reserved accumulatively.

The reserves for Earthquake Insurance on Dwelling Risks under the Act on Earthquake Insurance should be accumulated with the amount equal to net premiums minus net business expenses plus relevant investment income. When claims occur, the amount equal to net claims paid and outstanding loss reserves shall be withdrawn from these reserves.

Reserves for CALI are composed of obligatory reserves, adjustable reserves, reserves for investment income, and reserves for loading costs. Obligatory reserves means pure premiums plus assumed interest income arising from long-term contracts minus claims paid and outstanding loss reserves. Adjustable reserves are accumulated with obligatory reserves which are carried over 5 years.

2. Outstanding Loss Reserves

(1) Ordinary Reserves for Outstanding Losses

General insurance companies are required to establish, at the time of closing their account, outstanding loss reserves equal to the sum of outstanding claims, premiums returnable, and policyholder's dividends payable for events which have already occurred; and the said reserves should include the sum for any claim of cases still in dispute.

(2) IBNR

IBNR (Incurred But Not Reported) reserves have formerly been required for automobile insurance, personal accident insurance, general liability insurance, workers' accident compensation insurance, and life reinsurance, based on a Notice in Gazette No. 234, issued on June 8, 1998. The FSA has introduced a statistical evaluation method to estimate IBNR reserves effective from May 1, 2006. Consequently, the lines of insurance products for which general insurance companies are required to accumulate IBNR reserves have been expanded to include all lines of insurance products except for Earthquake Insurance on Dwelling Risks and Compulsory Automobile Liability Insurance. Furthermore, general insurance companies have been required to carry out screening and calculate the IBNR reserves for those long-tail insurance contracts based on a statistical evaluation method, when they are material.

3. Price Fluctuation Reserves

With regard to stocks and other assets designated under the Enforcement Regulation of the Insurance Business Act as those which may bring about losses due to price fluctuations, non-life insurance companies are required to lay aside the amount calculated in accordance with the Enforcement Regulation as price fluctuation reserves so that their claims paying ability can be duly ensured. This does not apply to cases where non-life insurance companies have obtained approval from the Commissioner of Financial Services Agency to be exempted from reserving the total or a part of the amount.

In addition, non-life insurance companies are allowed to dispose of price fluctuation reserves in order to make up for a deficit when the amount of losses resulting from the trade of stocks and other assets exceeds the amount of profits accruing from such trade.

Note:Underwriting and Outstanding Loss Reserves for Reinsurance Contracts

As regards reinsurance premiums ceded to the following entities, general insurance companies can be exempted from establishing underwriting and outstanding loss reserves:

a. licensed domestic insurers in Japan,

b. licensed foreign insurers in Japan,

c. unlicensed foreign insurers which are deemed to pose few risks to the sound management of ceding companies in terms of the condition of business or assets, etc.